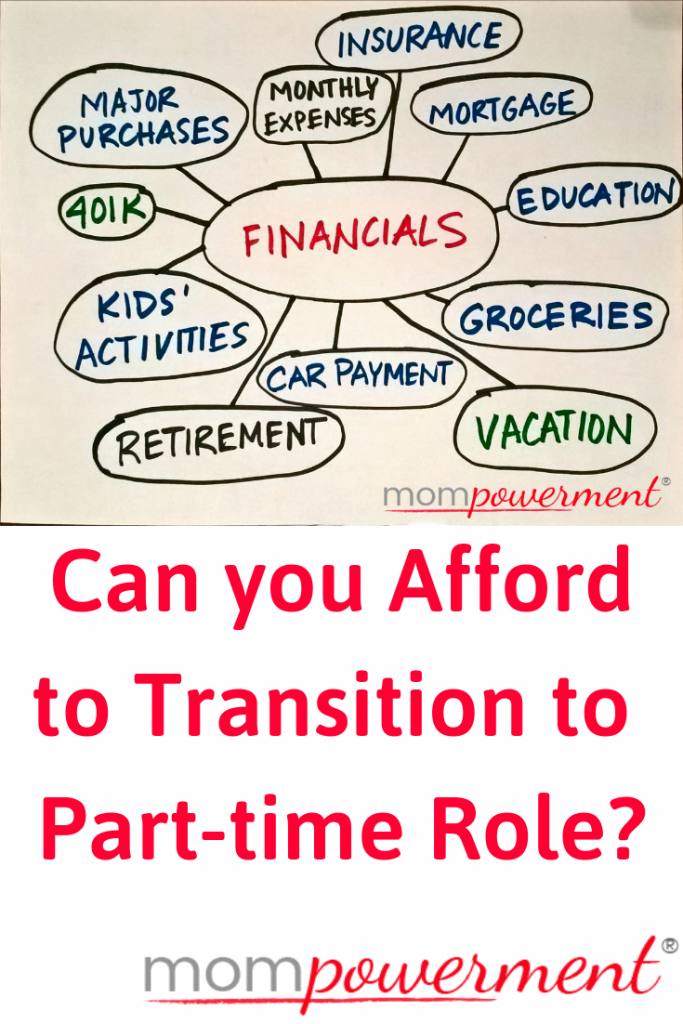

You’ve looked at your motivation and understood the implications on the personal and professional side of things, so what about the financial side of the equation? Can you really afford to transition to a part-time role, if you get a pay cut (notice how I didn’t say when you get a pay cut)? I can’t answer that, but I can get you thinking on the right track for you to figure it out. These questions aren’t all-encompassing and shouldn’t take the place of contacting a financial professional if you want to understand, without a doubt, your own unique situation.

Can Your Family Afford a Pay Cut?

Let’s start with how most working moms think things will go when they want to cut their hours. You cut hours and you get a pay cut. What are some of the questions you should consider to understand the financial implications of this scenario?

- How will a pay cut impact your family? What do the financials look like for you and your family if you get a pay cut?

- What costs do you need to be able to cover with your income so that you understand what level of income you need, even as a part-time employee?

- What lifestyle changes, if any, will you and your family need to make if your income level falls, however small?

Long-term Impact of Transition to Part-time Work

When you decide to transition to a part-time role, it’s not only the short-term potential drop in income that you need to consider. There can be long-term implications, including retirement. Let’s dive deeper to see if you can afford to transition to a part-time role.

- Does your retirement plan require your current income?

- Is your overall retirement plan flexible (e.g., can you take more time to work before you plan on retiring or maybe work fewer hours over time to get to your goals)?

- Will you need to make up lost income over time? Can you make that happen? Will you have time before you plan to retire?

- How will working part-time affect your social security (and/or retirement if that’s offered by your company or organization)?

- If you work for a company, if you go to part-time, how will it affect matching your 401K?

Other Financial Considerations

There are several other areas to consider, especially benefits, that impact your financial health. According to the most recent US Bureau of Labor Statistics Employer Costs for Employee Compensation Summary, benefits make up thirty to almost thirty seven percent of an employee’s compensation, depending on the type of employer. That’s part of why it’s really important to understand this side of your compensation.

- If you have insurance through work, will a transition to part-time affect that plan and overall coverage? Is there a minimum number of hours at which you maintain your benefits?

- Are there other benefits that will be impacted by a transition to part-time?

- If you have vacation or sick days accrued, how will a transition to part-time status affect that time?

- If you lose benefits, what does the benefits package look like through your significant other? Consider cost, changes in premiums, and level of coverage, especially for any existing conditions.

- If your significant other doesn’t have access to healthcare through work, what will coverage cost you?

- If you plan on getting pregnant again, how does a part-time status affect maternity leave?

Additional Questions before Becoming an Entrepreneur

On top of many of the questions that employees should think through, entrepreneurs have more financial questions to answer. You’re starting a business, which often has a degree of uncertainty, even with seasoned professionals with a strong network and years of work history at an employer.

- If your significant other doesn’t have access to healthcare through work, what will coverage cost you?

- Are your current financials stable and strong? Have you prepared financially for a lull in financials before new things get off the ground? Essentially, are your financial ducks in a row?

- How do your goals for your business compare to your previous salary? What is your specific plan to reach those goals? Do you have clients already lined up?

- How will you set pricing? How will you calculate your value in that pricing? (I’ll talk more about value in another blog, so keep an eye out for that.)

- Have you considered the tax implications of starting your own business?

- Have you looked at other costs (e.g., consider employment taxes (e.g., social security), benefits, life insurance, short-term and long-term

Your Financials Might Not Change with a Transition to a Part-time Role

I’ve given you a lot to think about for the situations when you do have a drop in salary or a drop in income if you transition to entrepreneurship. I saw again and again that a drop in income doesn’t always happen. Of, if it does, it’s not a substantial drop.

This is where understanding your value and what you bring to the table becomes even more important. Knowing your value can help you either maintain your current salary or have a smaller drop in income in comparison to the fewer hours you work (e.g., drop 20 percent in hours but only 10 percent in salary). I’ve written a whole blog on knowing your value to help you think through this.

As you’re starting to look at the financial side of part-time, what types of questions do you have? What kinds of conversations, whether with a significant other or your employer, are you having? I’d love to learn what new things you thought about as you read these questions related to whether or not you can afford the transition to a part-time role.

Keep in mind that I offer strategic help with the transition to a part-time role. While I can’t give you financial advice, I can give you ideas on things to think about and how to have conversations. We can strategize on various elements of the transition so that you feel more confident in how to propose and position your transition. It’s about the successful transition to a professional part-time role. Set up time today.